Madrid welcomes Chancerygate, the largest urban logistics real estate developer in the Uk

Chancerygate, the largest urban logistics real estate developer and asset manager in the UK, opens its office on Paseo de la Castellana in Madrid and appoints Felipe Lainez as Director of Development for Spain with a view to expanding into Europe.

Read more

Land Plots in Madrid Region

Madrid Region Goverment provides users and investors with a useful tool to inquire about plots and lands available for sale or concession.

Read more

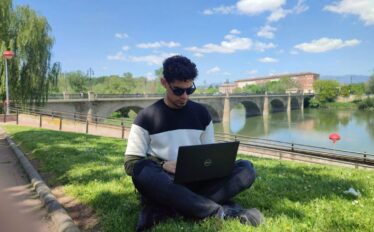

Visa for Digital Nomads

In the Community of Madrid and the rest of Spain, foreign workers can obtain a visa to telecommute for companies outside the European Union, with reduced taxation.

Read more

The Startup Law Aims to Attract Foreign Investment

The startup law offers a series of tax and bureaucratic advantages to facilitate foreign investment in emerging companies. Additionally, it streamlines the residency permits for foreigners with the aim of retaining highly skilled talent.

Read more

Contact with Invest In Madrid